2020 unemployment insurance tax refund

The IRS will process the 2020 tax return without Form 8962. Hi IKRAM 1998 The American Rescue Plan Act of 2021 enacted on March 11 2021 suspended the requirement to repay excess advance payments of the premium tax credit excess APTC for tax year 2020.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

If you reported an excess APTC repayment amount on your 2020 tax return but didnt file Form 8962 the IRS will reduce the excess APTC repayment amount to zero and process the return even if you didnt get a letter about a missing Form 8962.

. During the 2nd 3rd and 4th quarters of 2020 all eligible nonprofit reimbursing employers will only be billed for 50 of the unemployment benefits. Reimbursing Employers - The Office of Unemployment Insurance has elected to participate in the 50 liability relief from the Protecting Nonprofits from Catastrophic Cash Flow Strain Act of 2020. There is no need to contact the IRS.

If you already filed a 2020 return and reported excess APTC or made an excess APTC repayment you dont need to file an amended return or take any other.

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com

What To Keep In Mind About Your Unemployment Tax Refunds Wztv

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Is Unemployment Compensation Going To Be Tax Free For 2021 Gobankingrates

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

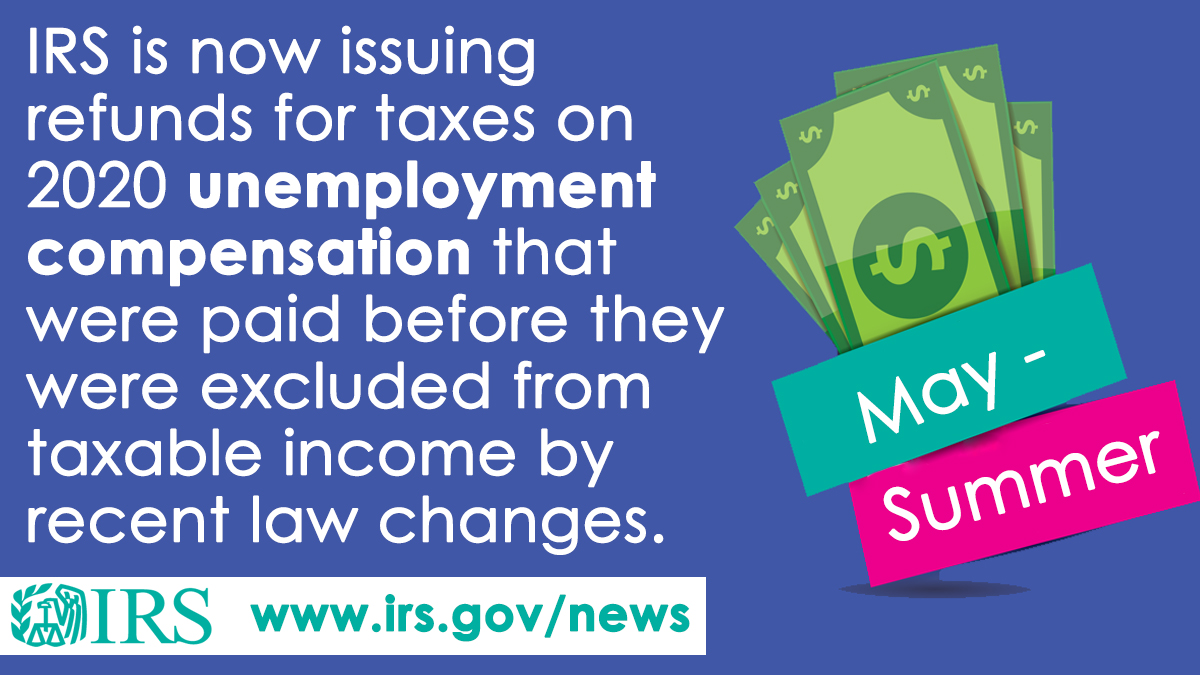

Irsnews On Twitter Irs Is Issuing Refunds For Taxes Paid On 2020 Unemployment Compensation Excluded From Income The First Adjustments Are For Single Taxpayers Who Had The Simplest Tax Returns Details At

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

Irs Unemployment Refunds Moneyunder30

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Unemployment Benefits Tax Free Do You Need To Amend Your 2020 Tax Return Youtube

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Tax Refunds On Unemployment Benefits Still Delayed For Thousands